Irs Gambling Losses Proof

IRS Tough On Gambling Loss Documentation

Determine your total gambling losses by consulting your gambling receipts. If you do not have proof of both your winnings and your losses, you cannot claim a deduction. File your income taxes using Form 1040. In Your Gambling Diary, Track Wins and Losses by Session. If keeping a gambling diary meant I had to track every single play, I probably wouldn’t bother (and I doubt anyone else would either). Thankfully, that’s not how the IRS asks you to track your wins and losses. Instead, the IRS wants you to track by session, where a “session. Note, your Bitcoin gains and losses are not the same as your gambling wins and losses. Let's work through a deposit example: You buy $1000 of Bitcoin at Bitstamp, receiving 0.0909 BTC (the currency abbreviation for Bitcoin). You deposit the 0.0909 BTC into an online casino and receive $1000 credit for it. Amount of your gambling winnings and losses. Any information provided to you on a Form W-2G. The tool is designed for taxpayers who were U.S. Citizens or resident aliens for the entire tax year for which they're inquiring. If married, the spouse must also have been a U.S. Citizen or resident alien for the entire tax year.

A recent decision of the Tax Court (in the Zetina Renner) case reminds folks of the rather strict IRS rules regarding documentation of any number of tax return deductions, including deductions for gambling losses.

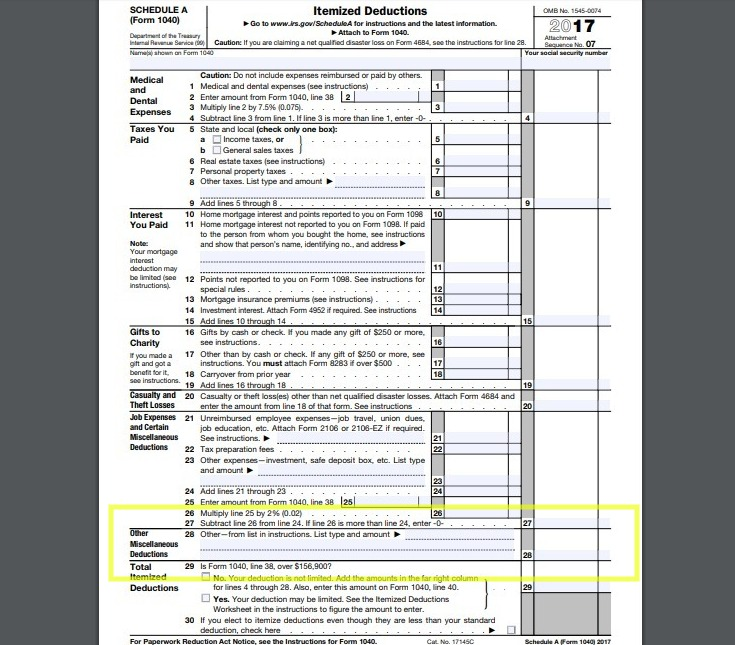

In the event the IRS takes a second, closer look at your tax returns, you will be able to easily prove any gambling losses tax deduction that you claimed. How to Report Gambling Losses Because you need to itemize to claim these deductions, you have to use IRS Form 1040 to report your winnings and losses.

The Courts love to remind us that tax deductions “are a matter of legislative grace,” with the taxpayer bearing the burden of proving entitlement to any deduction claimed.

In some cases, if the taxpayer establishes that an expense is deductible, but is unable to substantiate the exact amount, Uncle allows the taxpayer to estimate the amount, pursuant to an ancient case which established this Cohan rule.

In this case, the taxpayer claimed Schedule A (itemized deduction) gambling losses of $31,383 and $185,885 for 2009 and 2010 respectively. Using Caesar’s Entertainment (the gaming establishment in question) gaming history statements, however, the government determined the more correct numbers were $14,781for 2009 and $142,135 for 2010. The taxpayers argued that they “have proven their gambling losses more than satisfactorily through win/loss statements, bank withdrawals, a witness statement and credible and consistent testimony,” and that “any remaining concerns should be dealt with by employing the Cohan Rule.”

But not so fast – the taxpayer is required to maintain “permanent books of account or records as are sufficient to establish the amount of gross income, deductions, credits, or other matters required to be shown by such person in any return of such tax or information” say IRS’ regulations. Specifically in the case of gambling wins and losses the taxpayer can substantiate income and deductions by maintaining a contemporaneous log or by consistently using a player’s card to monitor gambling activity, the Courts have said. But in this instance, the taxpayers offered into evidence bank statements, some of which showed ATM withdrawals, point of sale purchases, and cash advances at or near casinos during the time period in question.

But cash advances or ATM withdrawals at or near a location generally are not sufficient by themselves, said the Court, to prove that the case was spent at that location or for any specific purpose. The taxpayers in this case did not provide credible testimony concerning the specific details of their gambling practices, thus rendering the Court unable to determine what portion, if any, of the taxpayer’s ATM withdrawals, point of sale debits, and cash advances was spent on gambling.

Result – deductions lost.

And if you’re one of those folks who just loves to get a refund upon filing your return, think again. Many people think this is just wonderful, using Uncle Sam’s withholding and related rules as a forced savings program – similar to the old “Christmas Club” routine which retail stores used to push.

According to the Tax Policy Center, in 2015, almost 73 percent of tax returns processed by April 17 received refunds which averaged just over $2,711. In total, the Federal government held $249 billion of excess withholding for some part of 2014 and 2015. Bad result for the taxpayer who achieved nothing more here than loaning Uncle Sam some dough for no interest in return!

CONSULT YOUR TAX ADVISOR – This article contains general information about various tax matters. You should consult your CPA regarding the implications to your own particular situation.

Proof Of Gambling Losses Irs

Jeff Quinn, the author of this article, is a shareholder in Ashley Quinn, CPAs and Consultants, Ltd., with offices in Incline Village and Reno. He can be reached at 831-7288, and welcomes comments at jquinn@ashleyquinncpas.com.